Backdoor Roth IRA: Key Strategy for Tax-Free Retirement Growth

February 4, 2026

Understanding the Backdoor Roth IRA Strategy

Navigating the world of retirement savings can be daunting. For high-income earners, the Backdoor Roth IRA offers a unique opportunity. This strategy allows you to bypass income limits and enjoy tax-free growth.

But what exactly is a Backdoor Roth IRA? It’s a method to contribute to a Roth IRA indirectly. This is especially useful for those who exceed the income limits for direct contributions.

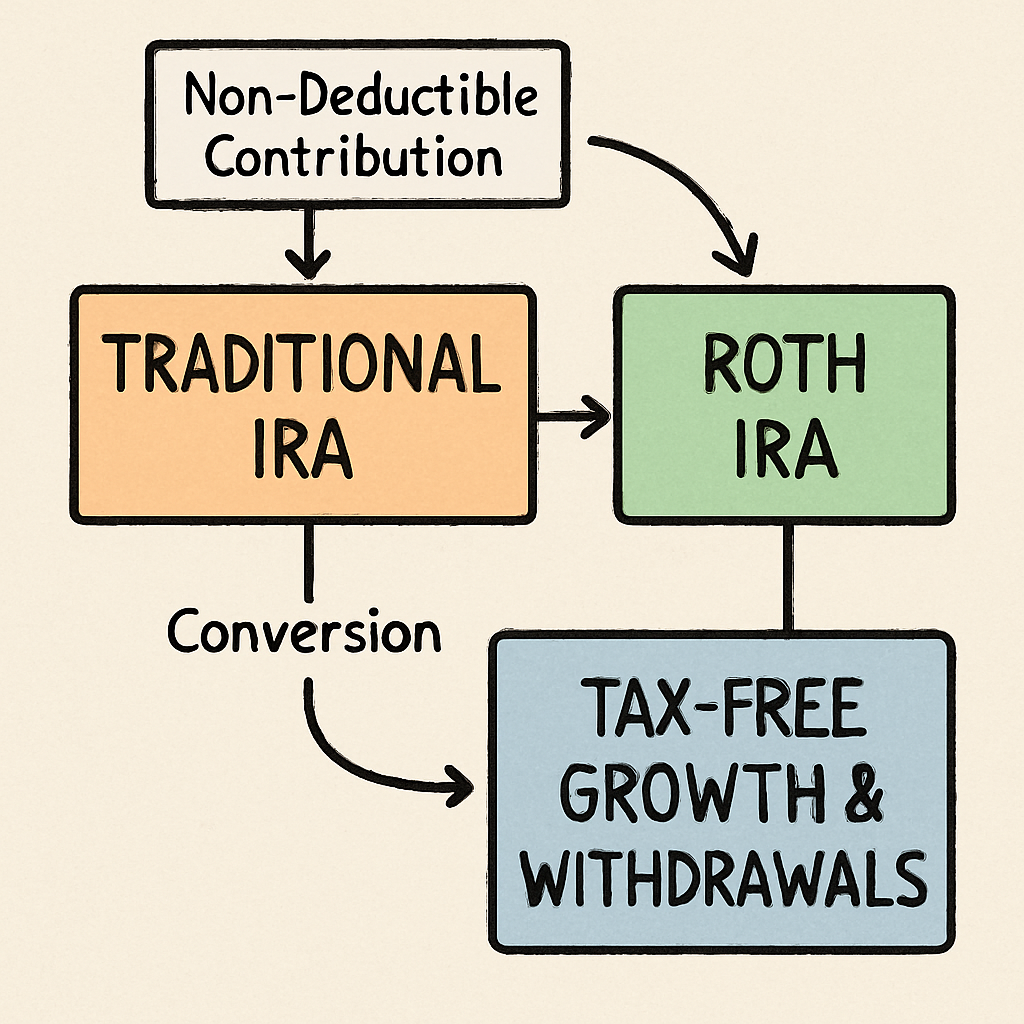

Understanding the nuances of this strategy is crucial. It involves making a nondeductible contribution to a traditional IRA. Then, you convert it to a Roth IRA.

This approach can be a game-changer for small business owners and retirees. It provides a way to secure tax-free income in retirement. However, it’s not without its complexities.

The pro-rata rule, for instance, can impact your tax liabilities. Timing and careful planning are essential to maximize benefits. Consulting with a financial advisor is often recommended.

In this article, we’ll explore the Backdoor Roth IRA in detail. We’ll cover its benefits, potential pitfalls, and how to implement it effectively. Whether you’re a small business owner or a retiree, understanding this strategy can enhance your financial planning.

What Is a Backdoor Roth IRA?

A Backdoor Roth IRA is a strategic tool in retirement planning. It allows high-income individuals to enjoy the benefits of a Roth IRA despite income restrictions. While direct Roth IRA contributions are limited by income, the backdoor method opens another route.

Here’s how it works:

- Make a nondeductible contribution to a traditional IRA.

- Convert the traditional IRA to a Roth IRA.

This method bypasses the Roth IRA income limits, which is its main appeal. The conversion doesn’t have income limits, making it accessible to those with higher earnings. It’s important to remember that the contribution to the traditional IRA itself is non-deductible.

The Backdoor Roth IRA can be a strategic move for those seeking tax-free growth. Upon conversion, any growth within the Roth IRA is tax-free, and withdrawals in retirement are also tax-free. This makes it an attractive option for those who anticipate higher taxes in the future.

Despite its advantages, this strategy can be complex. It’s crucial to understand the tax implications thoroughly. Especially if you have pre-tax funds in traditional IRAs, the pro-rata rule can affect your tax liability.

Careful planning is key to success with this strategy. When done correctly, it can enhance the efficiency of your retirement savings and provide robust benefits. Always consider consulting a tax advisor or financial planner for personalized advice.

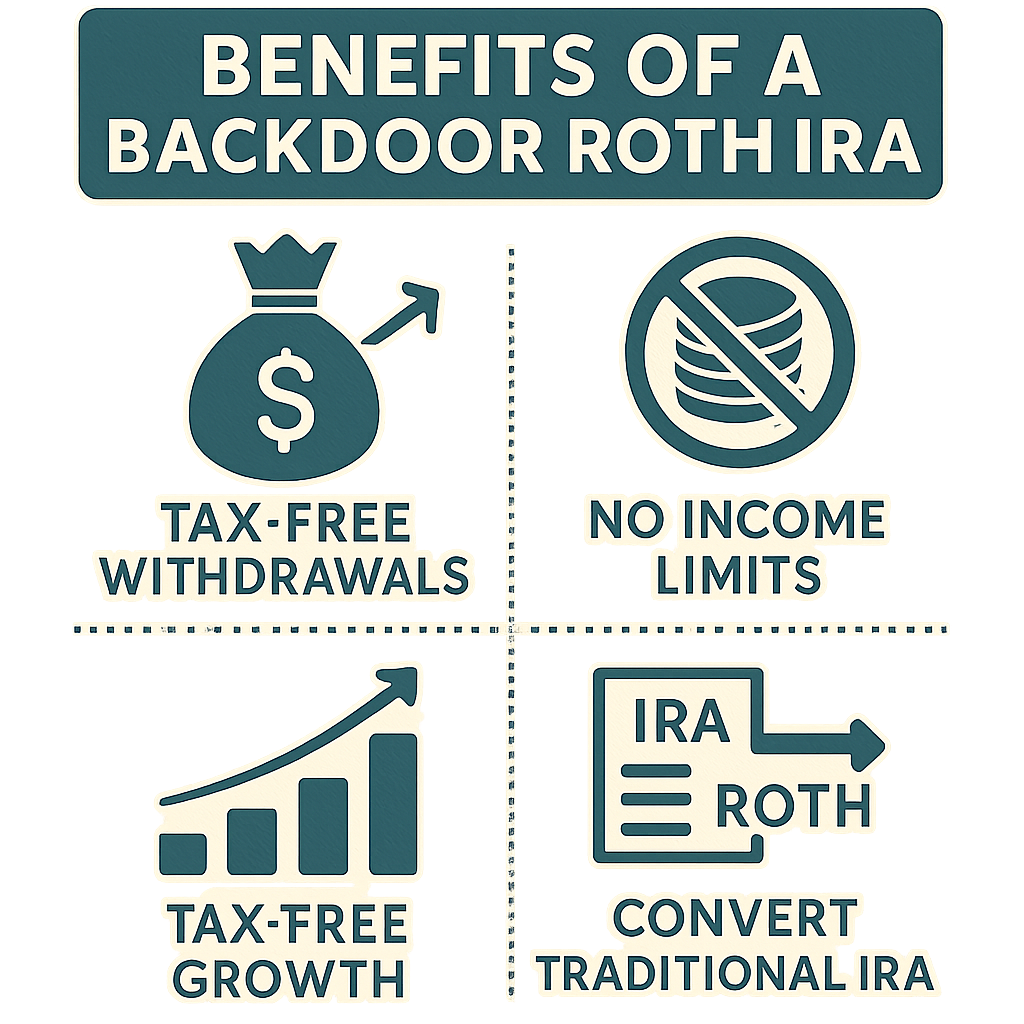

Why Consider a Backdoor Roth IRA? Key Benefits for Small Business Owners and Retirees

The Backdoor Roth IRA strategy offers distinct advantages for various groups, especially small business owners and retirees. It provides a unique opportunity to capitalize on tax-free growth in the years ahead.

For small business owners, this strategy is particularly appealing. Traditional business savings might not offer the same tax perks. By converting funds to a Roth IRA, they can enjoy future tax-free withdrawals, aiding in financial planning and stability.

Retirees can also benefit greatly from a Backdoor Roth IRA. It helps manage tax liabilities and offers a way to maintain tax-free income streams during retirement. This can be vital for retirees concerned about outliving their savings.

Additionally, this strategy serves to diversify one’s income sources. Having both taxable and tax-free income options in retirement can offer more flexibility and security.

Here are some key benefits:

- Tax-free growth and withdrawals: Roth IRA funds grow tax-free, a boon in retirement.

- No income limits on conversions: Even high earners can take advantage.

- Estate planning advantages: Roth IRAs do not have required minimum distributions (RMDs).

Careful implementation of the Backdoor Roth strategy is crucial to avoid pitfalls. Properly navigating this process can secure financial resilience and peace of mind. Engage a financial advisor to tailor the strategy to your unique situation for the best outcomes.

IRA Contribution Limits: What You Need to Know

Understanding IRA contribution limits is pivotal when planning your retirement strategy. These limits define how much you can contribute each year, affecting your savings potential.

For 2023, the annual contribution limit to IRAs, including traditional and Roth, is $6,500. If you are aged 50 or older, you can contribute up to $7,500, thanks to a catch-up provision. Knowing these limits helps you maximize your retirement savings efficiently.

When implementing the Backdoor Roth IRA, the contribution limit to a traditional IRA is significant. You make a nondeductible contribution to a traditional IRA and then convert it to a Roth IRA, side-stepping the income limits typically associated with direct Roth contributions.

Keep these points in mind:

- Standard contribution limit: $6,500

- Catch-up contribution (50+ years): $7,500

- Nondeductible contributions impact the Backdoor Roth strategy

by razi pouri (https://unsplash.com/@razipourjafari)

Aligning your contributions with these limits requires attention, especially when using the Backdoor Roth strategy. Proper planning ensures that you maximize your tax-advantaged savings each year, paving the way to a financially secure retirement.

How the Backdoor Roth IRA Strategy Works: Step-by-Step Guide

The Backdoor Roth IRA strategy is a legal and effective way for high-income earners to save for retirement. It involves converting funds from a traditional IRA to a Roth IRA, allowing for tax-free growth and withdrawals later. While the process may seem complex, breaking it into steps can simplify it.

First, create a traditional IRA account if you don’t have one. This account serves as the initial holding place for your contributions. Then, contribute to this traditional IRA. For 2023, you can contribute up to $6,500, or $7,500 if you’re 50 or older.

Next, ensure your contribution is nondeductible. This means you won’t take a tax deduction for your traditional IRA contribution. This step is crucial to avoid potential tax issues during conversion.

After your contribution, initiate the conversion to a Roth IRA. Inform your financial institution that you want to convert your traditional IRA funds to a Roth IRA. This conversion is not subject to income limits, making it accessible to high earners.

Here’s a quick checklist:

- Open a traditional IRA.

- Make a nondeductible contribution.

- Convert to a Roth IRA.

And remember:

- Use separate accounts for conversions.

- Track your contributions carefully for tax purposes.

- Consult a financial advisor if needed.

by Viktor Mogilat (https://unsplash.com/@mogilat)

Finally, report the conversion on your tax return using IRS Form 8606. This form ensures your nondeductible contributions are acknowledged, maintaining tax accuracy. By following these steps and keeping detailed records, you can efficiently use the Backdoor Roth IRA strategy to enhance your retirement savings.

Tax Implications and the Pro-Rata Rule Explained

Navigating the tax implications of a Backdoor Roth IRA can be tricky. Understanding these taxes is crucial for effective planning. Converting a traditional IRA to a Roth IRA usually involves taxes. You might pay taxes on the conversion amount, depending on your basis.

The pro-rata rule plays a significant role here. This rule requires that all traditional IRA accounts be considered when calculating taxes owed on a Roth conversion. It ensures taxes are applied uniformly, preventing you from selecting only certain funds for conversion.

For example, if you have both deductible and nondeductible contributions, the conversion tax is based on the proportion of after-tax contributions across all IRAs. Ignoring the pro-rata rule could result in higher taxes than anticipated.

Here’s what to consider:

- Total all IRA balances.

- Determine the after-tax contributions.

- Apply the ratio for tax calculation.

Timing is also important. Consider conversion in low-income years to minimize taxes. Additionally, keep state taxes in mind, as these vary by location and can impact the conversion’s tax burden.

It’s often wise to seek professional advice. A knowledgeable financial advisor can help you navigate these tax complexities. They ensure you’re maximizing retirement savings with minimal tax impact.

Using the Backdoor Roth IRA effectively requires understanding the pro-rata rule and tax timing. By doing so, you can enjoy tax-free growth without unexpected tax surprises.

Common Pitfalls and How to Avoid Them

The Backdoor Roth IRA strategy offers numerous benefits, but it’s not without pitfalls. Understanding these potential missteps can save you from costly errors.

One common mistake is not considering the pro-rata rule beforehand. This oversight can lead to unexpected tax liabilities. Calculate taxes accurately before proceeding with a conversion.

Timing conversions poorly is another frequent pitfall. Carrying out conversions in high-income years can result in higher taxes. Plan conversions during years of reduced income to lessen the tax burden.

Avoid these pitfalls by following these tips:

- Understand the pro-rata rule: Know how it affects your tax situation.

- Plan conversion timing: Aim for low-income years to reduce taxes.

- Consult experts: Engage a financial advisor for tailored advice.

Lastly, remember to keep detailed records of your contributions and conversions. Proper documentation protects you during audits and simplifies tax preparation.

By being mindful of these potential pitfalls, you can effectively leverage the Backdoor Roth IRA strategy. Avoiding common mistakes ensures you’re maximizing benefits while safeguarding your financial future.

Backdoor Roth IRA vs. Other Retirement Strategies

Choosing a retirement strategy can be overwhelming given the myriad options. Among these, the Backdoor Roth IRA stands out for its unique advantages. It provides a legal way for high earners to gain Roth IRA benefits, circumventing income limits.

Compared to traditional IRAs, the Backdoor Roth offers tax-free growth and withdrawals. This feature is particularly appealing if you expect higher tax rates in retirement. Unlike traditional IRAs, Roth IRAs have no required minimum distributions, allowing your investment to grow longer.

To better understand how the Backdoor Roth IRA compares, consider these points:

- Traditional IRA: Tax-deferred growth, but distributions are taxable.

- Roth IRA: Tax-free withdrawals, but income limits restrict contributions directly.

- 401(k): Employer-based, with higher contribution limits but limited investment choices.

by Brett Jordan (https://unsplash.com/@brett_jordan)

In essence, the Backdoor Roth IRA can be an effective tool for long-term wealth accumulation. Each retirement strategy has its merits, but the Backdoor Roth’s tax advantages make it a compelling choice for strategic investors. Understanding your financial goals and tax situation is crucial for selecting the right path.

Financial Planning Tips for Maximizing the Backdoor Roth IRA

Maximizing the benefits of a Backdoor Roth IRA requires a strategic approach. Effective planning ensures that you reap the full advantages of this retirement strategy. Here are several key tips to help you get started.

Firstly, consider the timing of your conversions. Converting when your income is temporarily lower can minimize tax liabilities. This strategy allows you to harness market downturns for more tax-efficient conversions.

Another important aspect is understanding the IRA contribution limits. For 2023, the limit is $6,500, or $7,500 if you’re 50 or older. Ensuring you do not exceed these limits helps maintain compliance and avoids unnecessary penalties.

Consider these additional tips:

- Track Your Basis: Maintain thorough records of non-deductible contributions to avoid tax errors.

- Utilize Spare Cash Wisely: If you have extra funds, consider additional non-deductible contributions.

Moreover, seeking professional advice is invaluable. Financial advisors can offer personalized guidance tailored to your situation. They can help navigate complex rules and optimize your strategy.

For small business owners and retirees:

- Regular Reviews: Assess your financial plan annually to ensure alignment with your life changes.

- Diversify Assets: Balance Roth conversions with other investments for a robust portfolio.

by Sebastian Herrmann (https://unsplash.com/@officestock)

Incorporating these planning tips into your financial decisions can significantly enhance your retirement outcomes. With careful strategy and expert advice, the Backdoor Roth IRA can be a powerful tool in your financial arsenal.

Is the Backdoor Roth IRA Right for You? Assessing Your Situation

Deciding whether a Backdoor Roth IRA fits your financial goals requires careful assessment. This strategy particularly benefits high earners limited by standard Roth IRA income restrictions. However, it might not be suitable for everyone.

Start by evaluating your current financial status and retirement plans. Consider the potential tax implications and how they align with your long-term objectives.

Key factors to assess include:

- Current Tax Bracket: Higher earners may benefit more from tax-free growth.

- Existing IRA Balances: Large traditional IRA balances may lead to higher taxes due to the pro-rata rule.

- Retirement Timeline: Younger investors can benefit from extended tax-free growth.

Understanding your unique financial landscape will guide your decision. Consulting with a financial advisor can provide clarity and help tailor a strategy that complements your retirement goals.

Frequently Asked Questions About Backdoor Roth IRAs

Many people have questions about the Backdoor Roth IRA strategy. These questions often revolve around tax implications and eligibility. Here, we clarify some common concerns.

One frequent question concerns the legality of the Backdoor Roth IRA. Yes, this strategy is completely legal and IRS-approved. It was created by a legislative gap in the tax code, making it a viable option for high-income earners.

Let’s address a few more common queries:

- What is the contribution limit for a Backdoor Roth IRA?

- The annual IRA contribution limits apply: $6,500, or $7,500 if you’re 50 or older.

- Does the pro-rata rule affect all taxpayers?

- Yes, if you have traditional IRA balances, the pro-rata rule impacts your tax calculation.

- Can anyone use the Backdoor Roth strategy?

- Primarily, it’s advantageous for those whose income exceeds Roth IRA limits. However, personal financial circumstances should be assessed carefully.

Building a Secure Financial Future with the Backdoor Roth IRA

The Backdoor Roth IRA strategy offers a powerful tool for securing your financial future. It allows high earners to benefit from tax-free growth and withdrawals. This strategy can effectively enhance the growth potential of your retirement savings.

Understanding and implementing the Backdoor Roth IRA can play a pivotal role in achieving long-term financial goals. By leveraging this technique, you can ensure a more diversified and tax-efficient retirement portfolio. Consulting with a financial advisor can provide personalized guidance tailored to your specific needs.

Not sure if a Backdoor Roth IRA makes sense for your situation?

Schedule a free, no-obligation consultation, and we’ll help you evaluate whether this strategy fits your goals, how the pro-rata rule may apply, and what next steps could look like based on your full retirement picture.